Immunization against tired, self-serving economic framing

We are taught to think of economic cause and effect as if it were understood almost as clearly as trajectory of an artillery round. For example, how many times—and in how many forms—have we been told to consider a proposed increase in the legal minimum wage (either state or federal) as a “job killer”? Every Republican in the U.S. Congress, and especially our current U.S. Representative from eastern Washington, Cathy McMorris Rodgers, jumps to seemingly plausible stories of how the poor or untrained young people just entering the work force will be disadvantaged by a rise in the legal minimum wage. Inevitably, McMorris Rodgers will trot out her youthful summer work experience toiling at her parents’ produce stand—as if her parents were legally bound to pay her minimum wage. The stated economic mechanism of “job killing” is always that employers, seeing their profits squeezed by increasing labor costs, will either hire fewer workers, automate the work with machines (cutting out low-skill workers), or be forced out of business.

Sadly, I heard this argument against the minimum wage from the mouths of business people and (mostly Republican) politicians so many times that, without thinking about it, the image of a disadvantaged youth priced out of the job market was always the first image that popped into my head when I heard the words “minimum wage”.

This “job killer” formulation is a sincere article of faith with people like McMorris Rodgers. The trouble is, as Nick Hanauer et al puts it, “Corporate Bullsh*t”. This “job killer” formulation long precedes McMorris Rodgers. It has been regularly trotted out since the minimum wage was first conceived in the 1930s—all on the basis of a made-up thought experiment and zero actual evidence. Simply by endless repetition many who ought to have questioned the concept, like myself, passively came to accept it.

Let’s twist the economic crystal ball a quarter turn for a moment. What if the legal minimum wage were raised to, say, $15/hr? Minimum wage workers would have enough money (“disposable income”) to occasionally spend some of it on a restaurant meal, or concert, or winter tires, or a better apartment, or…or. That extra spending, i.e. increased demand, would stimulate businesses to expand their operations and hire more workers, right? It turns out that actual data suggests that an increase in the minimum wage does NOT kill jobs, e.g. “High New Jersey Minimum Wage Doesn’t Seem to Deter Fast Food Hiring, Study Finds” from 1993 in the NYTimes. Sadly, the money behind the media affords studies like this minimal oxygen—and the brain worm of “job killer”, endlessly repeated, remains embedded in the public consciousness.

It turns out that many economic articles of faith put forth as if they were statements of fact are actually nothing but self-serving, empirically dubious, vaguely plausible conjectures that turn out, when subjected to empirical evaluation, to be false.

Nick Hanauer, Joan Walsh, and Donald Cohen have painstakingly assembled quotations illustrating the long history of this self-serving rhetoric in their new book “Corporate Bullsh*t” (avail by order at Auntie’s in “1-5 days” OR at Amazon). The text and the notes offer the modern, empirically based counter arguments.

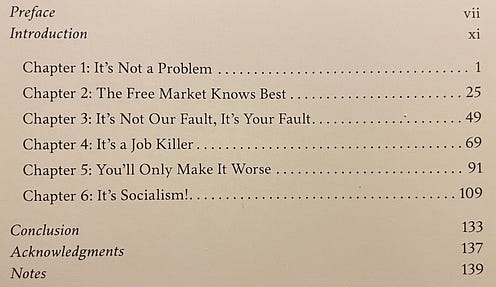

Below is the table of contents.

You will never hear one of these bogus economic arguments the same way again. For example. I recently attended a Spokane County Commissioner meeting at which Commissioner Al French interjected a notation that he was against state building code regulations to limit new natural gas infrastructure because it “would make housing more expensive and ‘hurt the poor’”. This dubious assertion comes under “Oh, those unintended consequences” (p. 108), a subsection of Chapter 5, “You’ll Only Make it Worse”. Whether Mr. French truly believes his assertion or not is only known to him. The point for me was that I was immunized against blithely accepting this dubious, simplistic formulation that he projected from the dais as if it were plain fact.

I recommend you buy or borrow “Corporate Bullsh*t”. It’s readable, ironically funny, well illustrated, and enlightening—and you’ll never hear politicians making tired points about economics the same way again.

Keep to the high ground,

Jerry